Technological innovation has long triggered diametrically opposed reactions: awe of new possibilities for some; for others, fear of disruptive change. But most of us don’t even realize what is happening. We take change for granted.

Human ingenuity is far too little recognized or appreciated, particularly in financial markets. Investors obsess about more pedestrian concerns: fears about a hard landing in China, the repercussions of falling oil prices, and the risk that some shock could tip a fragile world economy into renewed recession or deflation.

Obviously, worries about global demand conditions are not unfounded – surely the last thing the world economy needs now is renewed stress. Yet, for all our angst about excessive debt and policy inadequacy, nothing is as important as human ingenuity for delivering improved living standards and investment opportunities. Indeed, the advent of new technologies holds out the promise of a Fourth Industrial Revolution, the theme of this year’s World Economic Forum meeting in Davos.

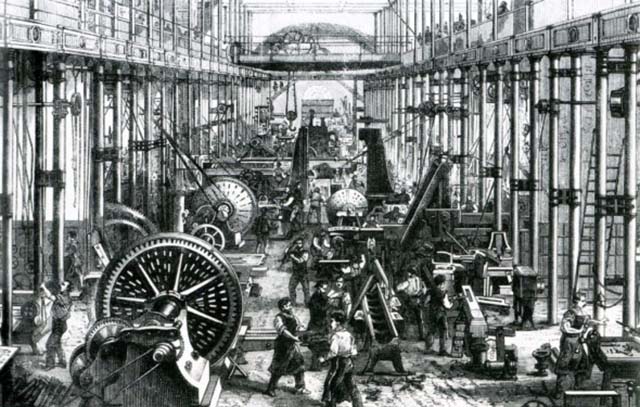

The First Industrial Revolution was based on the steam engine. James Watt’s invention, introduced around 1775, powered the nineteenth-century expansion of industry from its origins in England to Europe and the United States. The Second Industrial Revolution, from the last third of the nineteenth century to the outbreak of World War I, was powered by developments in electricity, transportation, chemicals, steel, and (especially) mass production and consumption. Industrialization spread even further – to Japan after the Meiji Restoration and deep into Russia, which was booming at the outset of World War I. The Third Industrial Revolution arrived at the end of the last century with the manufacture and diffusion of information technology.

The promise of a Fourth Industrial Revolution consists in advances in robotics, the Internet of Things, big data, mobile telephony, and 3D printing. According to one estimate, the successful adoption of these new technologies could boost global productivity by as much as the personal computer and the Internet did during the late 1990s. For investors, the fourth revolution offers opportunities for vast profits, akin to those delivered by its predecessors. Already, early movers in fourth-generation technologies command eye-popping valuations.

New eras of rising investment, productivity, and living standards are not just possible; they are probable, recurring with increasing frequency. And they are the result of human ingenuity. But new eras require more than basic science or garage-based entrepreneurial wizardry. To be transformative, technology must be adopted and diffused into everyday life.

This is easier said than done. At the very outset of industrialization, Watt struggled financially and did not successfully commercialize his steam engine until he formed a partnership with the English manufacturer Matthew Boulton.

More important, history suggests that enthusiasm – in macro and market terms – can run ahead of reality. One does not have to be a “productivity pessimist” (arguing, for example, that the indoor toilet was the last great human invention) to acknowledge that many new technologies deliver less than promised or reward investors only with long lags.

It is worth remembering that early steam power predated Boulton and Watt by nearly a century, and that it took more than a half-century for their invention to overtake conventional water-mill power as the mainstay of nineteenth-century industrial production. Volta first discovered electricity cells in 1800, but it took another eight decades to introduce direct current as a means of power transmission.

Likewise, ENIAC, the first electronic computer, was developed in secret during World War II. Computing power and usage grew exponentially over the ensuing decades of the twentieth century; but even as late as the 1980s, the Nobel laureate economist Robert Solow could quip that the computer age was “everywhere but in the productivity statistics.”

For investors, this consideration holds important implications – among them, the need to be patient and to resist the temptation to overpay early. Initially, identifying losers (who remembers Wang Computers?) may be as important as picking winners.

It is also important to understand how technology can transform seemingly unrelated industries. The advent of computing power enabled “big box” retailers in the US – Walmart, Staples, Home Depot, and others – to supplant both mom-and-pop stores and the established retail chains of the 1950s and 1960s. Computational power, together with advances in the logistics of transportation, storage, and delivery, enabled retailing on hitherto unimaginable economies of scale.

Yet today, these same big-box giants are under siege from online retailing, which promises even greater economies of scale and logistical efficiencies, undercutting even the most efficient brick-and-mortar operations.

Ingenuity it is. But, to paraphrase Joseph Schumpeter, it is also destructive. In today’s parlance, we speak of “disruptive technologies.” But no-one should be gulled by jargon: New ways of producing things often kill off old industries and jobs before the full benefits of the successor mode of production are realized. A certain degree of violence inevitably accompanies human progress.

That is why the executives gathering in Davos this month are discussing how to “master” the Fourth Industrial Revolution. For all the awe-inspiring promises of technological advance, theirs is an apt concern.

Home » Opinion » Mastering the Fourth Industrial Revolution

Mastering the Fourth Industrial Revolution

| Larry Hatheway